As the internet becomes more enmeshed in consumers’ daily lives, seeping even into its mundane moments (in marketing, we call these “micro-moments”), e-commerce draws more Asia-Pacific patrons who embrace electronic transactions in the name of modernity and convenience.

Research provider eMarketer forecasts that retail e-commerce sales worldwide will reach USD 5 trillion by 2021. At the moment, Asia-Pacific (APAC) leads the global e-commerce growth charge, outpacing all other continents with a forecasted growth of 25% or USD 2.271 trillion, representing a whopping 64.3% of global e-commerce spending.

The research also noted that six of the 10 fastest-growing retail e-commerce countries in 2019 hail from APAC, with India and the Philippines at the forefront with more than 30% growth; and China, Malaysia, Indonesia and South Korea trail closely.

And those figures represent retail e-commerce sales alone, which as a category is broad enough to include everything from clothing to garden equipment. What the report still doesn’t take into account are food services and online restaurant orders; travel and ticket sales; and even gambling and other vice good sales; which all hold promise in the brilliant future of e-commerce in APAC.

As e-commerce becomes bigger in APAC, competition among online businesses will only become tighter. As Sun Tzu’s saying goes: “Every battle is won before it’s ever fought.” Before heading for battle, here are the seven perspectives on e-commerce across APAC that every marketer needs to know.

Seven trends in e-commerce across APAC

1. Growth will be driven by the middle class

China’s economy may be cooling, but Alibaba is banking on high growth in e-commerce to drive sales. Investors say that its growth drivers include China’s middle class, as an increase in per capita income is correlated to increased internet penetration and consumer spending: two elements that e-commerce combines.

Meanwhile, e-commerce in Southeast Asia is projected to grow explosively, to exceed USD 100 billion by 2025, according to a study by Google and Temasek, which was quoted by Singapore Deputy Prime Minister and Minister for Finance Heng Swee Keat at the Grand Opening Ceremony of Shopee Headquarters Building on Tuesday, September 3.

As he opened the shopping platform’s 244,000-square-feet regional headquarters—whose size alone is proof of the positive outlook on e-commerce in the region—he said that the growth is fuelled by the region’s expanding middle class, which is expected to hit 350 million in the next three years.

As millions of Southeast Asians ascend out of poverty and into the middle class, not only will the demand for modest indulgences like snack foods and ready-to-drink beverages rise, but so will the demand for “affordable luxury” such as cosmetics and high-end consumer durables, according to Boston Consulting Group in its report “How the Digital Revolution Is Integrating Southeast Asia’s Consumers.”

2. There will be a luxury push

The same report noted that vis-à-vis the rise of Southeast Asian middle class is the even faster growth in the ranks of the affluent, the affluent being the people in the top 10% of the income pyramid.

A sign of the increasing importance of luxury to e-commerce is the recent announcement of Alibaba Group Holding Ltd’s SGD 2.7 billion acquisition of NetEaseKaola, which offers a curated collection of luxury goods to wealthy clients, primarily purchasing goods directly from suppliers to resell to consumers. The deal comes amid rumours of China’s e-commerce players looking to niche segments for growth.

The affluent market demands “experiential” products like restaurant dining and overseas travel. As they are well-traveled, they are internationally minded, discerning and interested in unique and customised products and experiences. Digital commerce, the report added, must be able to fulfil these needs, especially as the choices of affluent consumers have a strong influence on the aspirational middle-class.

The relevance of being extra careful in targeting the luxury segment online couldn’t be more emphasised after Dolce & Gabbana’s marketing faux pas in China.

ICYMI, in November of 2018, the Italian luxury fashion brand released a series of short videos to promote its upcoming Shanghai runway event called “The Great Show”. The videos presented an Asian woman in lavish Dolce & Gabbanna garb struggling to eat pizza and pasta using chopsticks. “Welcome to the first episode of ‘Eating with Chopsticks’ by Dolce & Gabbana”, a Mandarin-speaking voice narrates over Chinese folk music, before proceeding to discuss how to consume the dishes “properly.”

The politically and culturally inappropriate messaging did not sit well with the Chinese community, who then accused the Italian brand of racism. The show had to be canceled, and a video apology was recorded by Domenico Dolce and Stefano Gabbana themselves. Fast forward to a year later, Dolce & Gabbana has fallen 140 places in Asia’s Top 1000 Brands, a survey of consumer opinions across 14 markets in Asia-Pacific produced by Campaign Asia-Pacific in partnership with Nielsen. From position 360 last year it dropped to 500 this year, which in Campaign Asia-Pacific’s analysis “suggests a shift in Asian consumers’ sentiments about the brand.”

The post-mortem of Campaign-Asia Pacific goes on to include a quote from Terence Chu, the founder of the experiential agency Apax Group which helped organise the cancelled “Great Show.” The quote, which very much speaks about the power of social media, goes: “no matter where we come from, the world is getting smaller.”

3. Brands will produce more short-form video content

Dolce & Gabbana’s video campaign, though it failed, is one of the manifestations of the trend of a particular content format. As Generation Z and the millennials begin to step away from Facebook and explore platforms like YouTube and Instagram, they produce and consume more short-form video content.

Forbes cites that 91% of consumers today prefer interactive or visual content, such as video, over conventional static media. Internet video traffic, the report adds, is expected to have a compound annual growth rate increase of 33% from 2017 to 2022, on the back of new technologies like progressive web applications (PWA) to the pending materialisation of 5G.

Meanwhile, in a survey of more than 1,000 creative and digital marketing decision-makers by Mondo, 76% of respondents said that video marketing was their top priority for 2019-2020, and the video marketing types marketers plan to invest in most for their 2019-2020 strategies are Instagram stories (66%) and newsfeed videos (62%). The other top video marketing types for 2019-2020 cited are gifs (52%); cinemagraphs (31%); live streaming (28%) and IGTV (21%).

Known to produce highly viewed videos—both long-form and short-form—are influencers, who have proven an ability to move huge volumes of products on the back of their viral commentaries.

An example is Austin Li (李佳琦), a Chinese man dubbed “Lipstick King,” whose cult following on DouYin (China’s TikTok) run to for beauty advice. His DouYin prominence allowed him to sell 15,000 lipsticks in 15 minutes—at least according to this article by Weekender. Here is a video of him with his collection of 813 lipsticks:

4. Social commerce will rise

A consequence of the digital natives, the Generation Z, gaining more purchasing power as they get older, and compounded by the millennials’ fixation on social media comes the rise of a subset of e-commerce: social commerce.

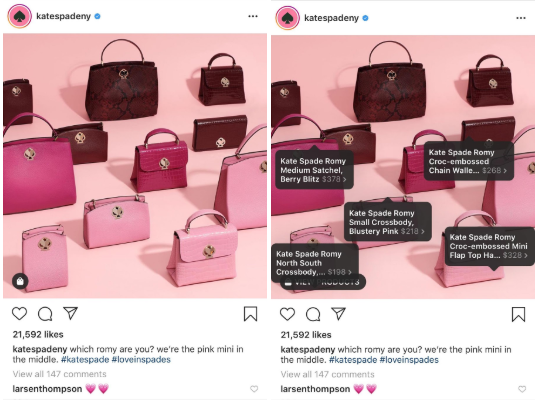

Social commerce assists consumers in buying products and services online via social media. On Instagram for example, users will see shopping bag icons on photos on profiles that have enabled social shopping. Users who tap on the photo will then see tags of the price and other product details of the items, and a direct link to where they can be purchased.

Screenshots of Instagram’s social shopping feature

With brands—and influencers—comfortably hawking their wares on social media and targeting their respective niches, social commerce leads socially connected consumers to the sales funnel faster.

In an August 2019 article, Entrepreneur called social commerce “the next billion-dollar market in India.” It says that the model succeeds over the traditional e-commerce model because it cuts the cost of overheads, operations and marketing while increasing reach and sales through the reseller network. Moreover, it adds that social media has deep penetration in the socio-economic middle and lower classes in India. Social commerce thus allows local manufacturers, suppliers and wholesalers to gain access to millions of users.

Expect major technological boosts from social media giants like Facebook and Instagram. Forbes has reported that Facebook has gone as far as to “discreetly develop a proprietary cryptocurrency,” as it seeks to “enter the payments market for what seems like an eventual integration of e-commerce features.”

5. Businesses should build consumer confidence in making payments on e-commerce platforms

A decade ago, not a lot of consumers would feel comfortable to hand over their card numbers to an online retailer, and let their bank accounts be automatically debited. That has changed greatly today.

But while more people now don’t mind transacting online, e-commerce also continues to grow because cash on delivery or COD options are available to consumers. Forbes calls this a double-edged sword, where though it allows sellers to reach customers who haven’t adopted the use of online payment systems, it can also hinder the digital economy from flourishing fully. The publication cites Southeast Asia, where e-commerce has the potential to build confidence in the region’s digital economy. By creating a backbone for everyday consumer interaction, it said, e-commerce can “drive sophisticated logistics networks across the region, provide access to any and every product, and help consumers feel comfortable making digital payments.”

In Asia, as in the rest of the world, payment cultures differ from country to country. According to PwC’s Global Consumer Insights Survey 2019, Vietnam is the fastest-growing global market in mobile payments, recording a 24% climb from last year, with 61% of its consumers tapping such services. Across the globe, China leads the pack with 86% of its population tapping mobile payments, followed by Thailand at 67%. The survey, which polled more than 21,000 respondents from 27 territories, reveals that the world’s top 10 mobile payments adopters are in eight Asian markets including Indonesia, Singapore, and the Philippines.

This diversity of preferred payment methods points online retailers and marketers towards an important aspect of developing its business strategy: considering varied local preferences. Inability of consumers to pay using their preferred method may lead them to make their purchases elsewhere.

6. Artificial intelligence will upgrade the shopping experience

Aside from social shopping, technological breakthroughs in AI or artificial intelligence will also give e-commerce sales a much-needed boost. Already, there is a plethora of AI applications in e-commerce.

At the moment, companies are starting to offer an end-to-end retail automation platform through AI to various industries, such as fashion. These companies use image recognition and data science to extract catalog data, analyse user behaviour and guide marketing strategies in improving customer experiences and driving conversions.

A number of companies online have also begun rolling out chatbots. Using deep learning and natural language processing, AI chatbots make human-like responses that address the customer needs, while taking note of patterns that overtime can be used to push highly-targeted offers. As they are not humans who need sleep, they can engage with customers 24/7. Read our previous article on how to yield an ROI from chatbots.

Chatbots are beginning to step away from the chat box and into the real world as actual smart robots. Dispatched in a warehouse for example, they can act on processes boxing items and preparing them for shipping. Interested to see them in action? Watch the timelapse video below.

7. Customer experience will be more omni-channel

But chatbots aren’t the only ones that are gaining physical manifestations of themselves—successful e-commerce players are also realising the substantive value of purveying goods in a physical store.

An example of this is Amazon, a name almost synonymous to the famous Kindle e-reader, which opened its first physical bookstore on November 2, 2015, in Seattle, Washington. And as of 2018, had a total of seventeen stores.

The Amazon Books outlet in at University Village, Seattle, Washington (Photo: Amazon)

Digital brands carry with them a unique experience as they enter the physical realm. For digitally native brands to integrate themselves offline, they can leverage their advantage in technology to build smarter stores.

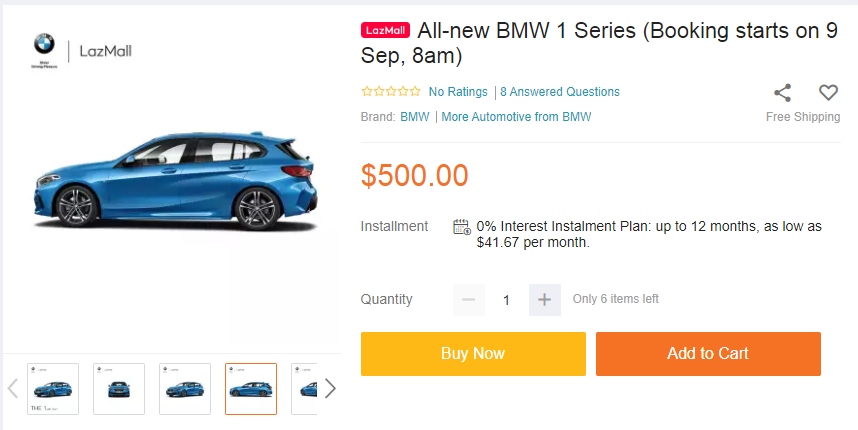

On the flipside, brick-and-mortar stores are also going digital, and this trend has even extended to high-ticket items. An example: luxury carmaker BMW dialed up its push online with the launch of a new car model on online marketplace Lazada. In an official release, BMW said that the collaboration between the auto manufacturer and the e-commerce giant is the “first-of-its-kind”, and that the pilot programme, which will allow customers in “tech-savvy” Singapore to place a booking fee on the BMW LazMall store. The move expands the luxury brand’s customer touchpoints from the showroom to their fingertips.

Screenshot of the BMW car model on LazMall, taken on September 10, 2019

As the retail industry as a whole evolves, and the borders between the digital and the physical world becomes more blurred, consumers increasingly demand a more integrated experience both online and offline. Google defines the phenomenon succinctly: omni-channel, it said, “[ensures retailer] marketing strategies are geared toward enabling customers to convert on any channel.”

With the variety of new and exciting touchpoints available at our disposal, now is a great time to be a digital marketer. The next step, we reckon, is using these tools to create a unique user experience that resonates with your customers.

Our team of highly experienced strategists, creatives, digital marketing specialists and technophiles can help you craft a future-proof marketing strategy. Reach us by email at enquiry@strategicdigitalab.com or fill in our enquiry form to discuss. You can also take a look at our list of services.